Best Practices

While a career in the Service can give most officers little time to attend to domestic matters, retirement can be gainfully used to organise one’s life more systematically. Towards this end, there are various best practices which can be followed by naval veterans, as – unlike in the Service – they would have to do most things by themselves. Such best practices also ensure that in the unfortunate event of your death, your spouse and dependents have much less running around to do, while disposing of your worldly assets in accordance with your wishes, including searching for details on the multitude of accounts that you were holding in various institutions.

-

In the unfortunate event of a veteran’s death, there are various actions – some immediate, others as a follow-up – that the spouse and next of kin may be required to take. Some of these are placed below for reference but are not all-encompassing. Immediate Actions on Death of a Veteran Arrangement for Assured Dignified… Read more

-

Joint Account It is a best practice to have your bank accounts – especially the pension account – as joint accounts with your spouse/child(ren), though this may be a matter of personal preference. This also facilitates the release of Life Time Arrears and Family Pension as and when the contingency arises. The advantage of having… Read more

-

Need for Financial Planning Naval veterans receive a regular pension (50% of last drawn emoluments for officers with 20+ years of service) under the One Rank One Pension (OROP) scheme. Family pensions (30-60% of emoluments) support dependents, in the event of the veteran’s passing. On retirement, veterans also receive a large lump sum corpus, which… Read more

-

Ageing is a gradual and continuous process of natural change that begins in early adulthood. Most veterans of NFPC retire when they are middle-aged, which is generally considered the period between 40-60. During early middle age, many bodily functions begin to gradually decline which tend to increase as one enters old age. Life expectancy of… Read more

-

The saying “Death and taxes are the only two certainties in life” is a famous quote attributed to Benjamin Franklin, one of the founding fathers of the United States. Hence, it is inevitable that while it is necessary for veterans to do financial planning during their post retirement year, they also have to pay taxes… Read more

-

Death is a certainty for all of us. While we hope that all veterans will be able to live long and fulfilling lives, it is also a fact that some of us may have to depart this world a little earlier. Whatever be the case, it is a best practice to plan for when that… Read more

-

A nominee is a legal trustee of the assets of the deceased i.e. a custodian. The nominee will only hold your money/asset as a trustee and is legally bound to transfer it to the legal heir(s) or beneficiary entitled to the deceased’s assets. A legal heir is the person bequeathed the asset in the will… Read more

-

The introduction of the Personal Computer in the early 1980s, the Internet – or more specifically, the World Wide Web – in the 1990s and the smartphone in 2007 has made our daily life quite different from what it used to be in the 20th Century. These technological marvels have provided us with the systems… Read more

-

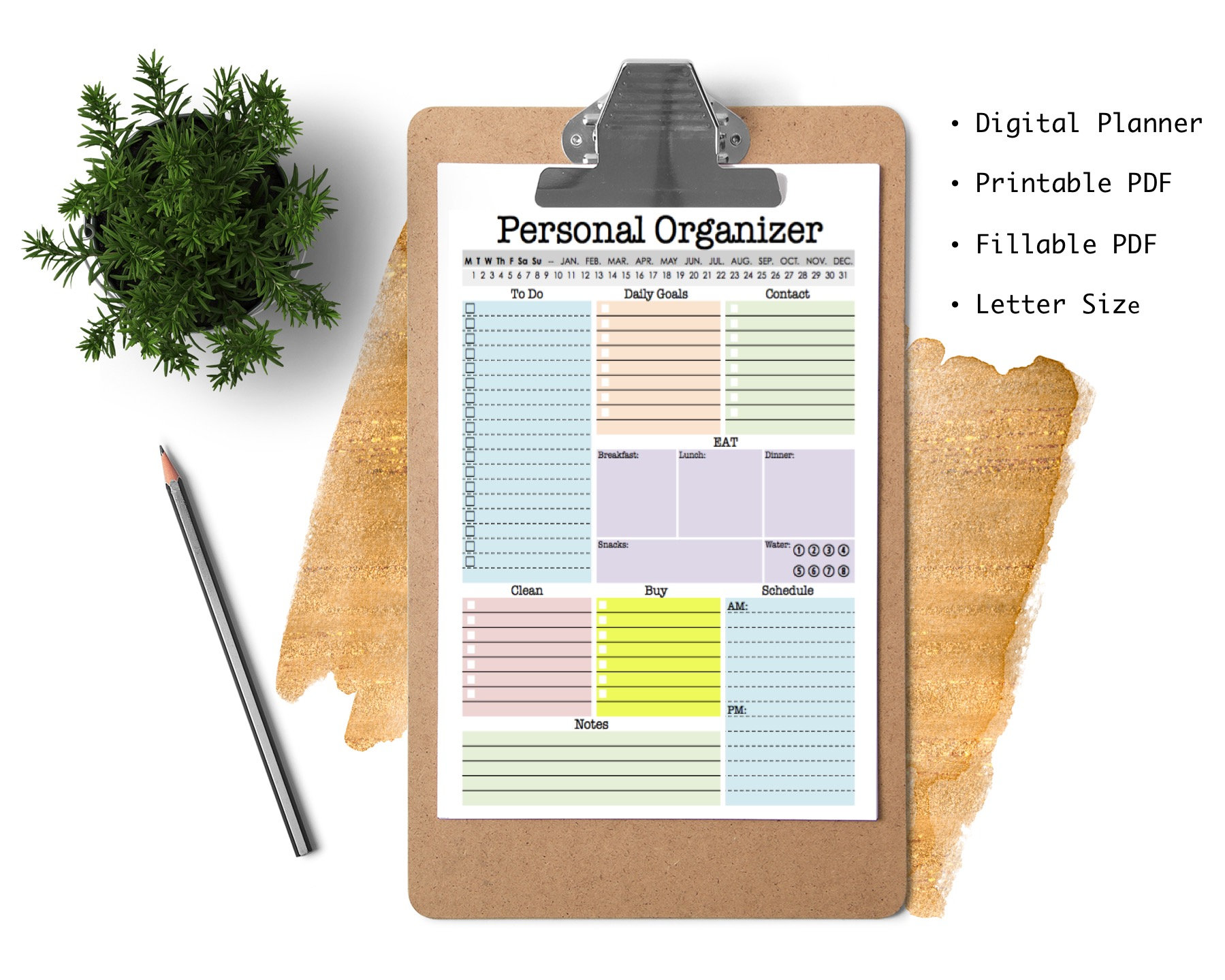

In addition to the Master Folder, it is also a best practice for the veteran to keep all his personal information in a secure, central location that his next of kin can access in the unfortunate event of his or her death. In addition to the information itself, a secure system of storing login id… Read more

-

A ‘Will’ or ‘testament’ is a legal document that expresses a person’s (‘testator’) wishes as to how their property (estate) is to be distributed after their death and as to which person (‘executor’) is to manage the property until its final distribution. Some Frequently Asked Questions about a Will are placed below and some specimen… Read more